- June sees mortgage approvals rise 0.6%

- Growth in number of small deposit borrowers

- Low mortgage rates entice existing homeowners back to market

The UK mortgage market grew between May and June, with a modest increase in the number of approvals.

The latest Mortgage Monitor from e.surv, the UK’s largest residential chartered surveyors, found that there were 65,823 residential mortgages approved in June 2019 (seasonally adjusted).

This figure is flat compared to the same month in 2018, but represents a 0.6% rise compared to May’s total.

The market was buoyed by strong activity among first-time buyers and those with smaller deposits, with the proportion of loans going to these types of borrowers increasing month-on-month.

In May, 27.7% of all loans were to these customers, a figure which rose to 27.9% a month later.

Existing homeowners, who have been to thank for much of the strong growth in the market so far this year, continued to come to market in June.

A combination of low mortgage rates and lenders changing their criteria to be more accommodating to these customers, has helped lure more current owners into the market.

This has worked to combat a lack of activity in the wider housing market, where fewer people have been making purchases in recent months.

Richard Sexton, Director at e.surv, comments:

“Summer can sometimes see a drop in or stall in activity, as would-be buyers take holidays and think less about their finances.

“Mortgage lenders have made a concerted effort to revamp their product ranges and launch new deals to help lure in borrowers.

“For existing homeowners, there are now a wide range of remortgage products available which are designed to help them cut their repayments and get greater certainty about their future outgoings.”

Monthly number of total sterling approvals for house purchases (seasonally adjusted)

Further growth in large deposit market

Borrowers with large deposits continued to grow their market share this month, as the number of mortgage approvals to this part of the market increased modestly.

Some 24.7% of all loans went to these customers this month. This is higher than the 24.5% recorded in May and further ahead of the 24.3% seen in April.

There was a similar rise in the number of small deposit borrowers in June. These buyers saw their market share increase from 27.7% to 27.9%, also a 0.2 percentage point increase.

These changes meant that the mid-market was squeezed this month, the proportion of loans to this market segment dropping from 42.8% to 42.4%.

On an absolute basis, the number of small deposit borrowers grew to 18,365 in June, rising from May’s figure of 18,227.

Richard Sexton, Director at e.surv, comments:

“We have seen an increase in the number of both small and large deposit borrowers this month.

“This is likely a result of more first-time buyers getting on the ladder and also existing homeowners with lots of equity choosing to remortgage.”

Proportion of large deposit loans by region

Northern Ireland claims crown as first-time buyer hotspot

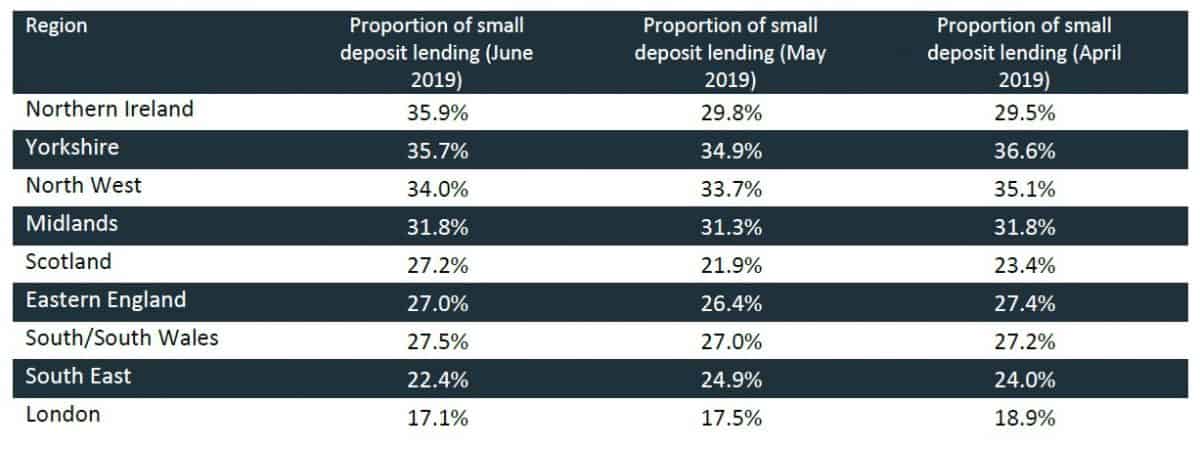

Yorkshire was toppled as the best location for small deposit borrowers to purchase, with Northern Ireland taking its crown.

Northern Ireland took top spot after Yorkshire’s five successive months as number one throughout 2019 so far.

Some 35.9% of all borrowers in Northern Ireland had small deposits, a figure which will include many first-time buyers. This compared to 35.7% in Yorkshire.

The North West – at 34% – was the other region which saw more than a third of its loans going to small deposit customers.

As usual, London was the area with the smallest proportion of these customers, at 17.4%.

The capital had the highest proportion of large deposit buyers, with 33% of all borrowers from this category.

This was ahead of other regions, including the South East, where 29.3% was recorded, and the South and South Wales at 24.9%.

Proportion of small deposit loans by region

Richard Sexton, Director at e.surv, concludes:

“Yorkshire has spent five months at the top of the charts but has finally been toppled this month as the best spot for first-time buyers.

Northern Ireland has leapfrogged its rival in this survey, but would-be buyers in Yorkshire shouldn’t despair, the regions remain an excellent place for those with small deposit borrowers to buy.

“However, buyers in London have a much tougher time, as this market remains dominated by those buyers with cash to splash.”

Data source: e.surv Chartered Surveyors

Data from: June 2019