- December activity was up compared to previous year

- Remortgage deals tempted existing homeowners back to market

- Yorkshire ends year as small deposit hotspot

There was a spike in mortgage approvals for borrowers across the country in December as the market ended the year on a high.

The latest Mortgage Monitor from e.surv, one of the UK’s largest residential chartered surveyors, found that there were 66,253 residential mortgages approved during the final month of 2019 (seasonally adjusted).

This level of activity represents a jump of 1.9% from November’s total and an increase of 2.7% when compared to the same month last year.

Some analysis has attributed this spike in activity to the clear general election result, which put an end to months of speculation and uncertainty.

First-time buyers have been major beneficiaries of low rates in recent months, but existing homeowners have also taken advantage of the increased competition between mortgage lenders.

Interest rates in the remortgage market have also fallen and this has tempted many borrowers to switch to a cheaper deal.

Reflecting this shift, the proportion of mortgages approved to first-time buyers and others with small deposits fell from 27.7% to 25.5% during the month.

This was because mid-market borrowers increased their share of the market substantially during the last month of the year.

Richard Sexton, Director at e.surv, comments:

“There have been ups and downs over the course of the year but 2019 ended on a positive note for the UK mortgage market.

“December’s decisive election result does seem to have put an end to the atmosphere of uncertainty which has dominated the property market this year.

“With more certainty on the future, it appears that many new buyers and existing homeowners have chosen to enter the market, leading to a spike in approvals in December.”

Monthly number of total sterling approvals for house purchases (seasonally adjusted)

December boost for mid-market mortgage borrowers

The year ended with a rise in the number of mid-market borrowers, as those with both small and large deposits saw their market shares slip back.

In December, 27.3% of approvals were to those with large deposits, down compared to the 28.9% recorded during the previous month.

Meanwhile, the proportion of small deposit borrowers also declined, falling from 27.7% in November to 25.5% during the following month.

These changes meant that the share of loans going to mid-market borrowers, those borrowers who do not fit into either of the other two categories, rose once again.

In December, 47.2% of all mortgages went to these borrowers, significantly higher than the 43.4% market share found in November’s survey.

This meant that, on an absolute basis, the number of small deposit borrowers was 16,895. This figure is lower than the 18,248 total recorded a month ago.

Richard Sexton, Director at e.surv, comments:

“Remortgage rates were low throughout December and this appears to have tempted many homeowners to switch to a new, cheaper deal.”

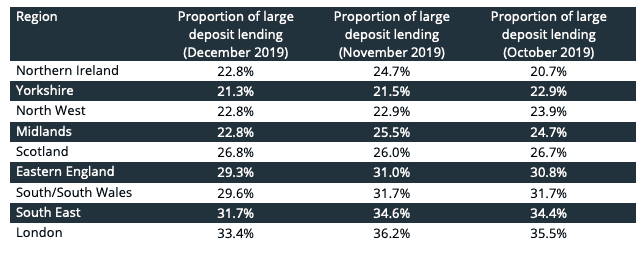

Proportion of large deposit loans by region

Yorkshire is 2019’s star performer for first-time buyers

Home buyers with small deposits had to contend with very different market conditions across the UK over the course of 2019.

One consistent thread, however, was that Yorkshire was regularly ranked the best region for small deposit buyers throughout the year.

In December, 32.3% of all mortgages in the Yorkshire region went to borrowers with smaller deposits, far higher than any other region.

The closest challenger was the North West, where 30% of all loans went to this market segment in December.

Throughout the year, first-time buyers in London faced the toughest market conditions, and this was no different in the final month of 2019.

Just 18.5% of approved loans in the capital went to these borrowers in December.

By contrast, 33.4% of mortgages in London were handed to those with large deposits. This was the highest figure in the country.

Close behind was the South East, where 31.7% of all loans were to this market segment.

This was followed by the South and South Wales on 29.6% and then Eastern England on 29.3%.

Proportion of small deposit loans by region

Richard Sexton, Director at e.surv, concludes:

“The prominence of Yorkshire as a small deposit hotspot in 2019, serves as a reminder that the UK’s property market remains heterogenous and divided. The contrast between the Yorkshire and London markets, for instance, remains stark.

“Any analysis of the UK market should engage with its regional nature and acknowledge that pockets of value do exist, even for borrowers with smaller deposits.”

Data source: e.surv Chartered Surveyors

Data from: December 2019